How Much Tax Can Be Saved On Home Loan

Use icici bank tax saving calculator to find out how much tax you can save while applying for a home loan at icici bank. Tax benefits on home loan repayment.

Home Loan Tax Benefit Claim Tax Deduction On Home Loan

Home Loan Tax Benefit Claim Tax Deduction On Home Loan

how much tax can be saved on home loan is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark how much tax can be saved on home loan using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Tax benefit on interest of the home loan.

How much tax can be saved on home loan. Not many know about this but but having a home loan can actually help save income. How much will my adjustable rate payments be. First home loans help you improve your credit score through regular and timely payments of the emis for a number of years.

15 or 30 year loan term. Every principal and interest payment made against your home loan can be claimed for deductions in your income tax. Tax benefits on home loans are overhyped.

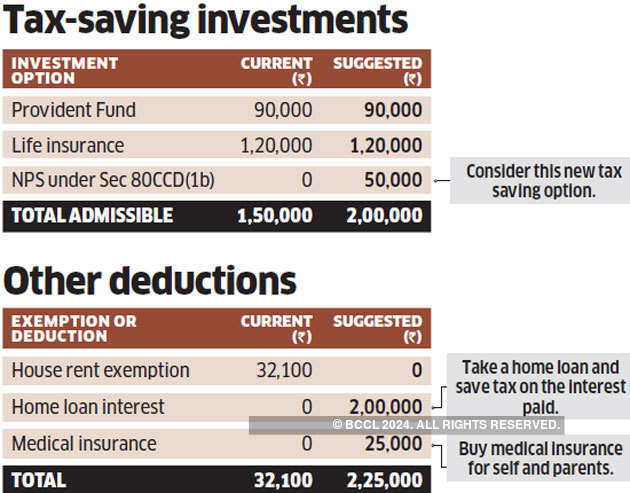

You can save over rs 1 lakh in tax just via these 4 avenues the i tax act 1961 provides several avenues by way of deductions under different sections of the act to help one invest or make an expense to reduce the tax outgo. Thus this tax saving calculator will help you in calculating the benefit that you can claim in the income tax by buying a home. Second home loans offer you a number of tax benefits which can help you reduce your tax outgo.

You have excess cash in hand from the last bonus you received and the fixed deposit that just matured. Should i pay points to lower the rate. How much can i save in taxes.

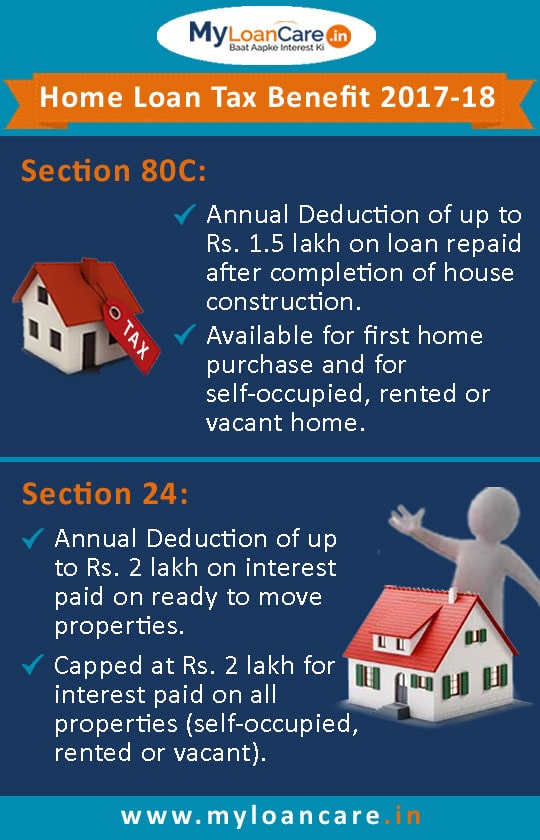

The housing loan emi consists of principal amount as rs. You can get benefits as per section 80c and section 24. How much should i put down for a new home.

If you taken house loan and want to know how can having a home loan save you income tax you will know here. Lets take a look at tax benefits you can avail if you have taken a home loan or plan to in the near future. How can i reduce mortgage insurance costs.

Income tax slabs and tax rate income up to rs 250000 no tax income from rs 250000 rs 500000 5 4 of income tax on health and education cess income from rs 5000. Your home loan can also help you to save taxes on your income. Mr x has availed a home loan and is tied up with emi installments.

How much will my fixed mortgage payments be. You have been thinking about how to use the funds. It is the second component of the income tax levied on home loan.

The tax calculation depends upon the income tax slab you fall into. 1 50000 deductible under section 80c and interest amount as rs 2 000 00 deductible under section 24 of the income tax act. It is possible to seek tax benefit on the interest of the home loan under section 24 and under the newly described section 80ee inducted in the year 2013 and applicable from 1st april 2013.

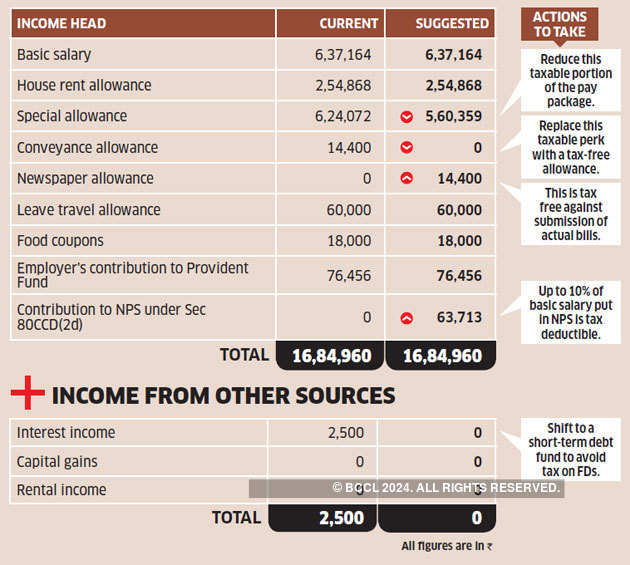

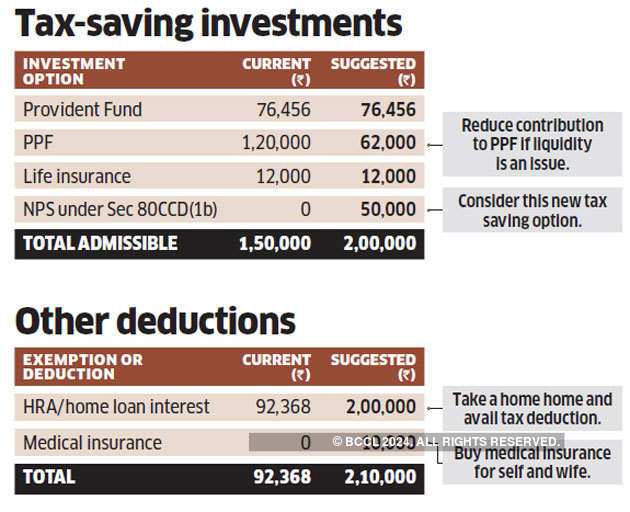

Save Income Tax Tax Optimiser How It Professional Gupta

Save Income Tax Tax Optimiser How It Professional Gupta

Tax Optimiser Anand Can Cut Tax By Rs 1 Lakh By Using Home

Tax Optimiser Anand Can Cut Tax By Rs 1 Lakh By Using Home

Tax Savings Home Loans Can Help You Save Tax Times Of India

Tax Savings Home Loans Can Help You Save Tax Times Of India

Money Talk Learn To Save On Tax From Home Loan

Money Talk Learn To Save On Tax From Home Loan

How Can Having A Home Loan Save You Income Tax Quora

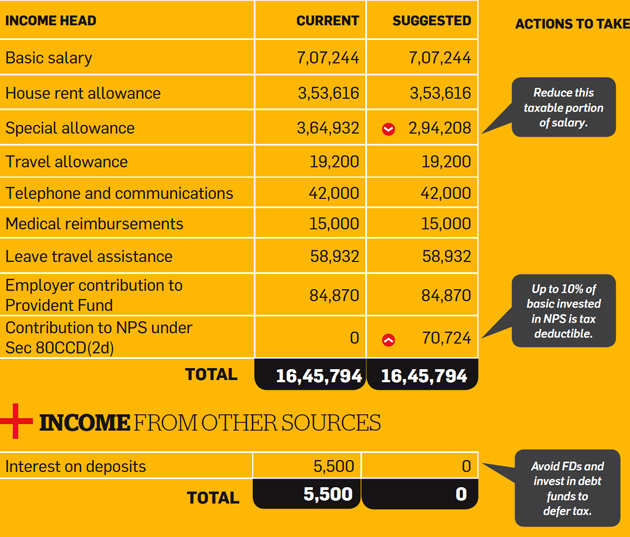

Tax Optimizer Tax Optimizer How Home Loan Nps Can Help

Tax Optimizer Tax Optimizer How Home Loan Nps Can Help

Home Loan Tax Benefit Calculator Family Tax Benefit Home

Home Loan Tax Benefit Calculator Family Tax Benefit Home

Home Loan Tax Benefit How To Save Taxes Against Your

Save Income Tax Tax Optimiser How It Professional Gupta

Save Income Tax Tax Optimiser How It Professional Gupta

Know About Income Tax Benefit On Home Loan

Know About Income Tax Benefit On Home Loan

Home Loan And Tax Saving Learn Itr Legalraasta

Home Loan And Tax Saving Learn Itr Legalraasta