Tax Benefit On Second Home Loan In Different City

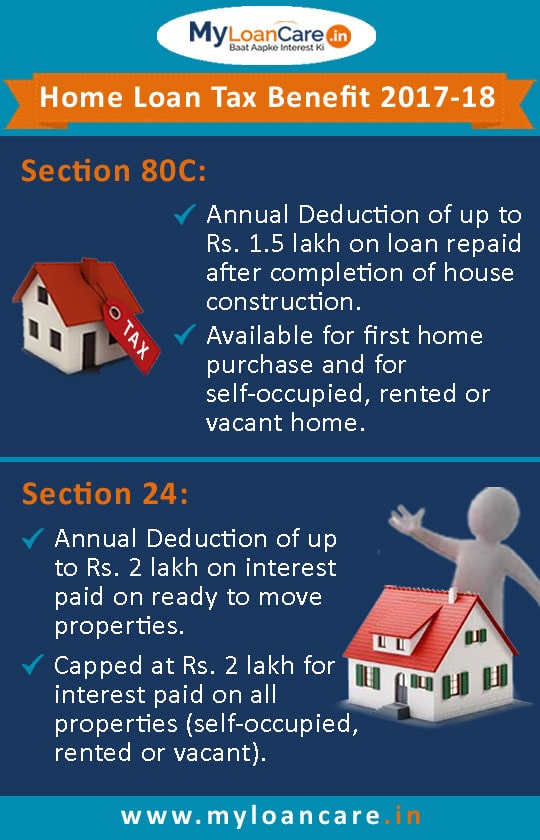

However in case of home top up loans tax deduction is only applicable for the interest paid on the loan under section 24b of the it act. Available tax benefit on home loan under section 24 80c for up to 200000.

Planning To Buy Second Home For Rental Income Here S How

Planning To Buy Second Home For Rental Income Here S How

tax benefit on second home loan in different city is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark tax benefit on second home loan in different city using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

The emi for the second loan is more than that for the first one.

Tax benefit on second home loan in different city. 2 nd home loan tax benefit depends on a few factors. There are many people in india who opt for second home loan for buying a second home to earn extra incomebuying a second home with the second home loan can be an attractive investment. But before opting for second home one should keep in mind the tax implications under the income tax act 1961 of the second home.

Furthermore the act does not have any provisions for tax benefits on home loan balance transfer despite having no restrictions on the number of times one can transfer hisher home loan. I know prior to fy2017 2108 the interest claimed on the second house loan had no limits provided the property was rented out and rental income was considered. However before you proceed consider these tax implications and benefit applicable.

Similarly there is no restriction on the number of houses for which. I am availing of tax benefit on my home loan and have recently bought a second house. Can i claim tax benefit on the second house.

As the law allows a person to own multiple homes and avail of multiple home loans we look at the implications on tax exemptions on the home loan for the second house there is no restriction on the number of properties you can own. 1 if you have taken a home loan for the second house you are eligible to claim a deduction for the interest you have paid. Tax rebate for self occupied rented property second home as per budget 2019 20 for ay 2020 21.

I have a question regarding the 2nd home loan benefits which can be claimed for the income tax from this financial year onward.

Home Loan Tax Benefit Claim Tax Deduction On Home Loan

Home Loan Tax Benefit Claim Tax Deduction On Home Loan

Planning To Buy Second Home For Rental Income Here S How

Planning To Buy Second Home For Rental Income Here S How

How To Buy A Second Home Bankrate Com

How To Buy A Second Home Bankrate Com

Buying A Second Home Consider These Tax Implications The

Buying A Second Home Consider These Tax Implications The

Home Loans Additional Tax Deduction Of Rs 1 50 Lakh On

Home Loans Additional Tax Deduction Of Rs 1 50 Lakh On

Home Loan Tax Benefit Claim Tax Deduction On Home Loan

Home Loan Tax Benefit Claim Tax Deduction On Home Loan

Second Tier Entitlement And Va Loans A Simple Explanation

Second Tier Entitlement And Va Loans A Simple Explanation

How To Give Your Home To Your Adult Child Tax Free Marketwatch

How To Give Your Home To Your Adult Child Tax Free Marketwatch

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png) Claiming Home Mortgage Interest As A Tax Deduction

Claiming Home Mortgage Interest As A Tax Deduction

/121770765-56a938cd3df78cf772a4e67d.jpg) Claiming Home Mortgage Interest As A Tax Deduction

Claiming Home Mortgage Interest As A Tax Deduction

Yes You Should Pay Off Your Mortgage Before Retiring The

Yes You Should Pay Off Your Mortgage Before Retiring The